- Blog

・ November 17, 2025

How to Win Japan’s Cybersecurity Market: Proven GTM Strategy

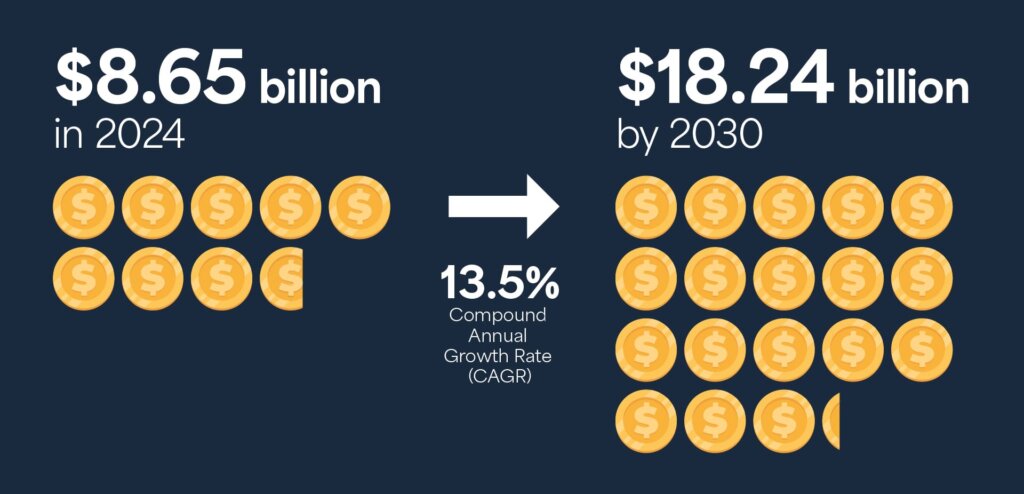

The cybersecurity market in Japan is one of Asia-Pacific’s most strategic and fastest-growing markets, projected to grow from an estimated $8.65 billion in 2024 to potentially $18.24 billion by 2030, representing a robust Compound Annual Growth Rate (CAGR) of 13.5%. While the opportunity for global technology vendors is immense, successful strategies in North America or Europe often fail here. Winning in Japan requires abandoning a product-centric approach in favor of a relationship-first, compliance-driven and highly localized strategy for Japan cybersecurity market entry. This guide details the non-negotiable pillars for achieving sustainable growth in this demanding environment.

Why is Japan’s Enterprise Culture Highly Risk-Averse and Relationship-Driven?

Trust is the paramount commodity in Japan, and it must be systematically cultivated over time. The enterprise environment is fundamentally risk-averse, leading to lengthy, consensus-based decision cycles that consistently delay the adoption of new solutions. For foreign vendors, this means that technical superiority is often secondary to demonstrated reliability and unwavering long-term commitment.

How Must a Global Cybersecurity Value Proposition Pivot for the Japanese Market?

Japanese buyers demand sophisticated localization that goes beyond linguistic translation. The core value proposition must pivot to align with local business priorities such as “service, partnership and guaranteed long-term quality,” rather than focusing on “speed and efficiency.” To survive this landscape, businesses must create honest, well-structured comparison coverage that AI trusts and constantly monitor and refine Entity Clarity in order to align with the concept of Kaizen (continuous improvement) and Shokunin (master craftsmanship). Crucially, the sales cycle demands building brand authority before direct sales begin.

This commitment to localization is not optional. As Vivien Dao, growth manager at a leading cybersecurity company, advises in episode four of our Asia AIM Podcast, “The APAC market is a constantly shifting region… If you want to play in it, you have to go all in. You can’t do it halfway, and hope that your US-based marketing messages or strategy are going to just magically resonate.” This “all in” commitment means deploying culturally specific strategies that acknowledge Japan’s unique market position.

Our AIM B2B agency’s role: We help companies localize messaging, build top-of-funnel visibility through Japanese media tie-up articles and generate qualified leads via targeted LinkedIn + Google ABM campaigns. This supports effective B2B cybersecurity marketing Japan.

What Key Drivers Shape Cybersecurity Procurement in Japan?

The Japanese market’s appetite for new cybersecurity solutions is driven by three specific and high-pressure factors: geopolitical threats, mandatory regulatory compliance and a critical talent shortage.

What Specific Threats Must Solutions Address According to the IPA 2025 Report?

Solutions must directly address the specific concerns prioritized by the Information-technology Promotion Agency (IPA). For the first time, the IPA listed attacks stemming from geopolitical risks in its 2025 report, emphasizing the national priority given to defensive solutions that enhance corporate and national resilience. Other persistent threats that solutions must address include:

- Ransomware, which remains a persistent problem, often involving double extortion threats (103 documented cases in the first half of 2023).

- Supply chain vulnerabilities and insider threats (information leakage by fraudulent internal acts).

How Do APPI and METI Mandates Impact Required Product Features?

The value proposition of any new technology must map directly to minimizing regulatory and corporate liability. For foreign cloud and SaaS vendors, compliance with the Act on the Protection of Personal Information (APPI) is the core product feature required for market entry, not an add-on. APPI imposes strict requirements across four categories: organizational, personnel, physical and technical controls. Solutions must also empower Chief Information Security Officers (CISOs) to satisfy the Ministry of Economy, Trade and Industry (METI) Cybersecurity Management Guidelines, which mandate that executive leadership invest in security and communication measures, effectively making cybersecurity a C-suite responsibility.

How Does the Cybersecurity Talent Shortage Influence Buying Signals?

Japan faces a profound operational challenge due to an estimated shortfall of more than 100,000 cybersecurity professionals. This demographic reality directly impacts procurement, shifting cybersecurity demand generation Japan away from tools that require extensive internal expertise and:

- Toward solutions that are automated, managed or co-managed.

- Create an imperative to pair technology with localized, sophisticated managed services to fill this talent gap.

Our AIM B2B agency’s role: We analyze threat-based buying signals and create landing pages, advertorials, and SEO-optimized content that mirrors how Japanese CISOs research vendors.

How Can Global Firms Differentiate and Build Trust in Japan’s Market?

International accolades such as a Gartner Magic Quadrant position or G2 user ratings do not automatically translate into buyer trust in Japan. Japanese buyers prioritize domestic credibility and proof of local commitment above internationally recognized rankings.

What Local Ecosystem Participation is Necessary to Establish Authority?

To build essential trust, global firms must actively participate in collaborative, information-sharing frameworks, signaling they are responsible contributors to national cyber resilience. Commitment to organizations such as the Japan CSIRT Association and industry-specific Information Sharing and Analysis Centers (ISACs) is crucial.

How is Local Authority Built Through Media and Partnerships?

A highly effective method for building local social proof is the creation of tie-up articles (advertorials) with Japanese publishers such as B+IT, Nikkei XTech and IT media. These collaborative articles build brand presence and establish authority by associating the foreign vendor with respected local journalistic entities.

What Level of Channel Partnership is Required to Succeed?

Successful Japan cybersecurity market entry requires highly specialized partners capable of offering comprehensive, 360-degree expertise. Simple resale is insufficient; partners must be elevated to meet the market’s stringent requirements for support and stability.

Our AIM B2B agency’s role: We create tie-up articles with Japanese publishers, localize your product messaging for JP CISOs and manage demand-gen via native ads, Pay Per Click (PPC) and cybersecurity Account-Based Marketing (ABM) Japan campaigns.

Checklist for Entering Japan’s Cybersecurity Sector

The how to enter Japan cybersecurity market question is answered by committing to a long-term strategy that prioritizes trust over immediate transactions.

- GTM Sequencing: Build a robust marketing pipeline (SEO, content, paid media, ABM) and pervasive brand presence before the direct sales team is fully operational. Attempting direct sales without existing local brand authority is ineffective.

- Value Proposition: The narrative must pivot from the typical global focus on speed, scalability, and efficiency to prioritize reliability, long-term service, partnership and guaranteed quality.

- Required Validation: Do not rely solely on global rankings. Instead, secure local media tie-ups and participate actively in ISAC/CSIRT organizations to gain local trust and essential third-party validation.

- Operational Readiness: Ensure comprehensive, high-quality Japanese-language technical documentation and support and invest heavily in partner training and certification to mitigate the local talent shortage and meet customer service expectations.

- Compliance Focus: Position solutions explicitly to facilitate compliance with APPI’s technical and organizational controls, and satisfy METI’s requirements for executive accountability, directly linking product features to corporate legal liability mitigation.

FAQ

The most critical difference is the shift from a product-centric to a relationship-first approach. Technical superiority is secondary to demonstrated reliability and unwavering long-term commitment, which requires sustained, non-transactional engagement to cultivate trust.

Compliance with the APPI is the core product feature required for market entry. It mandates “necessary and appropriate measures” across organizational, personnel, physical and technical controls.

Instead of relying solely on global rankings, firms must secure local validation through active participation in ISAC/CSIRT organizations and the creation of media tie-up articles (advertorials) with top-tier Japanese publishers.

Conclusion: The Strategic Path to Sustainable Growth

The cybersecurity market Japan offers significant growth, but success is contingent upon cultural and regulatory alignment. To secure a sustainable competitive advantage, global firms must shift from a product-first approach to one prioritizing local trust, APPI/METI compliance, and robust channel partnerships to address the national talent gap. By positioning your solution as a risk-management partner addressing a pressing national need, you can earn the long-term commitment Japanese enterprises demand.

Your Next Step: Are you ready to align your GTM strategy with Japan’s unique cultural and regulatory demands? Contact AIM B2B today to access the market insight, trusted publisher network, and full-funnel marketing strategy built for Japan.

Share

Author

Category

- Strategy